Acquiring new customers is critical, and it’s not free.

Whichever method you use to attract new users to your product, there’s always some cost associated with it. It might be as straightforward as purchasing a Facebook ad or a more indirect cost such as paying a content writer to write an SEO-friendly blog post.

If you understand the cost structure of user acquisition, you can act on it and optimize it. In the long run, lower customer acquisition costs lead to more users or funds for product development.

Because the product itself plays a crucial role in user acquisition, every product manager should have a solid understanding of their growth engine.

Table of contents

- What is customer acquisition cost (CAC)?

- How to calculate customer acquisition cost (CAC)

- How high should customer acquisition costs be?

- How to calculate customer lifetime value (LTV)

- How to reduce customer acquisition cost

- Key takeaways

What is customer acquisition cost (CAC)?

In simple terms, customer acquisition cost (CAC) is the amount of money spent to acquire new customers.

There are various components of customer acquisition costs. The exact price structure depends on your growth model and might include:

- Salaries and bonuses of the sales team

- Cost of sales delegation trips

- Salaries and bonuses of the marketing team

- Advertisement costs

- Partnership and campaigns costs

How to calculate customer acquisition cost (CAC)

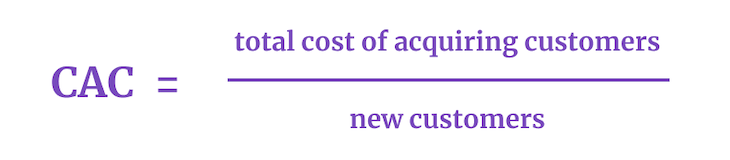

To calculate the average customer acquisition cost (CAC), combine all acquisition costs and divide this figure by the number of new customers acquired in a given period.

The formula to calculate CAC is as follows:

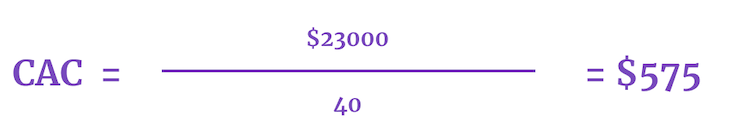

For a practical example, let’s say that, in June, you spent:

For a practical example, let’s say that, in June, you spent:

- $8,000 on the marketing team

- $15,000 on paid Google ads

Meanwhile, you acquired 40 new customers.

The CAC calculation for the example above would be as follows:

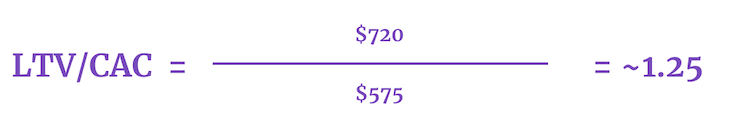

In this scenario, the cost of acquiring a single new customer in June was $575.

How high should customer acquisition costs be?

In the example above, we calculated our customer acquisition cost of $575. However, the number itself doesn’t tell us much about whether it’s a bad or good result.

Although you want your CAC to be as low as possible, high customer acquisition costs are not necessarily bad.

Optimal CAC depends heavily on customers’ lifetime value (LTV). Lifetime value tells us, on average, how much revenue one customer provides us during their whole lifespan.

How to calculate customer lifetime value (LTV)

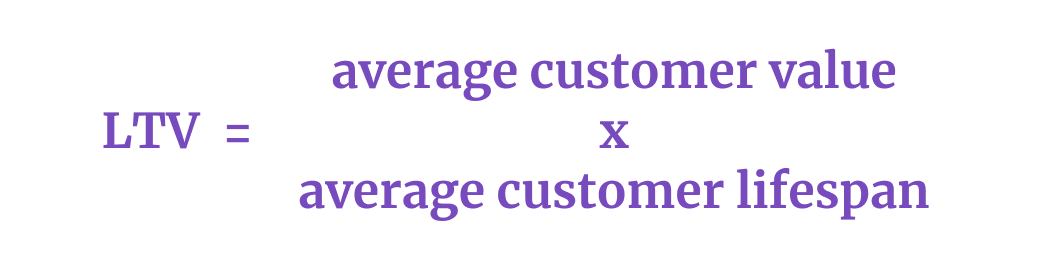

To calculate customer lifetime value (LTV), multiply an average customer’s value with their average lifespan.

The formula to calculate average customer lifetime value is as follows:

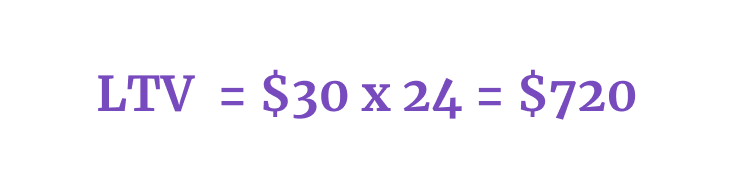

For example, in the case of an SaaS product, we could use:

- Average customer value = Average monthly subscription cost

- Average customer lifespan = Average number of months in service before churning

So, if the average subscription cost is $40 and users use the service for an average of two years, then:

Having calculated both lifetime value and customer acquisition cost, we can develop an LTV/CAC ratio:

What is a ‘good’ customer lifetime value (LTV)?

As a general rule of thumb, 3 or higher is a healthy ratio — meaning you earn at least three times the amount you spent acquiring each customer.

This means that even a CAC as high as $5,000 per customer is perfectly fine if the LTV of every customer is, say, $30,000. On the other hand, $3 CAC is exceptionally high if you only earn $4 from every new user.

In some cases, lowering the LTV/CAC ratio might be beneficial if it allows you to get more customers in the long run. Imagine two scenarios where, in both cases, LTV is $100.

- Scenario 1 — Spending $10,000 on marketing to get 1,000 (total LTV = $100,000) users

- Scenario 2 — Spending $20,000 on marketing to get 1,500 (total LTV = $150,000) users

Technically speaking, scenario 1 has a more beneficial LTV/CAC ratio of 10 compared to 7.5 in scenario 2, but when we do the math, the second scenario has a higher total profit:

- Scenario 1 — 1,000 x $100 – $10,000 = $90,000 revenue

- Scenario 2 — 1,500 x $100 – $20,000 = $130,000 revenue

Of course, this example is a simplification and doesn’t include things such as the cost of maintaining every single active user. The point is that there isn’t a perfect answer to how high CAC or LTV/CAC ratio should be. In every case, it all comes down to math.

As a general rule of thumb, the lower the CAC and the higher the LTV/CAC ratio, the better.

How to reduce customer acquisition cost

The customer acquisition cost is steadily rising. It has increased by roughly 60 percent in the last five years and is poised to continue to rise.

Reasons for the rise in CAC include:

- Ever-increasing competition

- Banner blindness

- New privacy and tracking regulations

This increasing customer acquisition cost is a severe threat to most businesses. To mitigate these risks, you should do whatever you can to lower their acquisition costs.

Tactics to reduce customer acquisition cost include:

- Maximize conversion

- Improve targeting

- Experiment with growth strategy

- Build growth loops

- Master one growth channel

Maximize conversions

Conversion is one of the key factors impacting average customer acquisition cost.

If you pay $0.20 for every visitor and your visitor-customer conversion is 1 percent, then you need 100 visitors ($20) to get a customer. If you improve the conversion to 2 percent, you need half the number of visitors for half the cost ($10).

Maximizing the conversion rate is one of the highest-leverage activities you can do when it comes to minimizing the overall CAC.

Improve targeting

When you show an ad to the wrong persona or your salesman approaches the wrong type of business, you’re just throwing money away.

The less focused your targeting is, the higher the chance of losing money by approaching the wrong people.

Specificity is the key. Define the type of user persona your product targets and ensure your acquisition efforts focus on that persona. Don’t just throw money against the wall.

Experiment with growth strategy

Experiment with your acquisition tactics as you experiment with your product-market fit.

Try different messaging, graphics, or ad/email titles. See what converts the best, double down on winners, cut losers, and keep experimenting. It takes time and plenty of failed campaigns to discover what truly resonates with end-users.

Your first campaign, e-mail, or promo video will never be your best one. The more you experiment, the better you will acquire new users and the cheaper it will be.

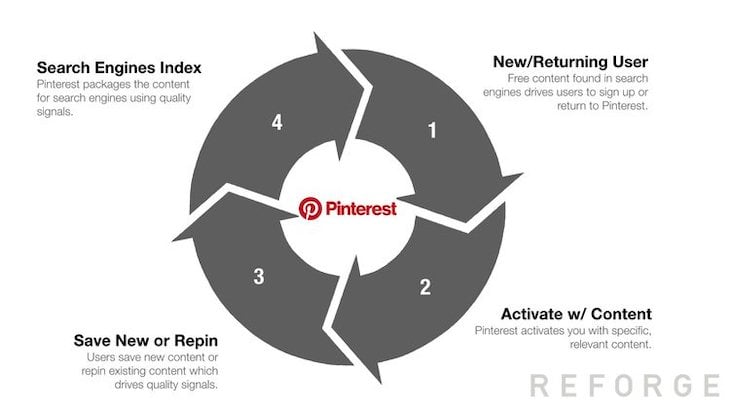

Build growth loops

Growth loops are mechanics where new users indirectly bring more users with them. Pinterest is a great example:

- The user finds a new Pinterest photo via the search engine

- The user creates an account.

- The user repins an image or uploads a new one

- The search engine indexes the picture

- Repeat

A healthy growth loop is the ultimate solution to lowering customer acquisition costs. An ideal loop will even allow you to acquire new users for free.

Master one growth channel

One of the easiest ways to lose money is to invest in multiple growth channels simultaneously.

There are multiple ways to grow a product, including:

- Performance marketing

- Virality

- SEO

- Sales

- Partnerships

Usually, there’s one growth channel that fits the product the best. The goal is to find it and adjust the product and strategy to maximize its potential.

Don’t try to master all distribution channels. It will only drive your customer acquisition costs crazy.

Key takeaways

Customer acquisition cost (CAC) tells us how expensive it is to get new users. Whether a given CAC is high or low depends on the overall LTV/CAC ratio and the ultimate return on investment.

The cost of acquiring new users is growing yearly due to increasing competition and new data privacy laws. For this reason, entrepreneurs and product managers should seek ways to minimize their overall customer acquisition costs.

Although there are many micro-tactics and growth hacks to lower the CAC, the most important ones are:

- Choosing the right growth channel

- Creating healthy growth loops

- Targeting right audience

- Maximizing conversions

- Experimenting with growth strategy

Don’t neglect your acquisition strategy. It doesn’t matter how great your product is if no one uses it.

The post What is customer acquisition cost and how to reduce it? appeared first on LogRocket Blog.

from LogRocket Blog https://ift.tt/EUzR9eI

Gain $200 in a week

via Read more