Organizations follow a wide range of product strategies. Some companies aim to lead in innovation, some are fast-followers, and others are cost leaders. They back these strategies with their core competencies to differentiate their products in the market.

The type of market and maturity of the offering determine the kind of differentiation required to be successful in the market. An organization needs to understand the differentiation it can profitably offer based on the resources available (including human, capital, and partnerships).

In this guide, we’ll provide a clear definition of what product differentiation means and how organizations operating in various markets can make their products stand out from the crowd.

Throughout the article, we’ll refer to real-world examples and help demonstrate what product differentiation looks like in practice and how a strong differentiation strategy can set you apart from your competitors.

Table of contents

- What is product differentiation?

- Horizontal vs. vertical product differentiation

- What does a product differentiation strategy look like?

- Recognize current and potential trends

- Pinpoint what you can offer and identify opportunities to differentiate

- Determine internal stakeholders and superpowers

- Measure and monitor

- What is RoA and why does it matter?

What is product differentiation?

Let’s start with a simple definition of differentiation.

Product differentiation is an endeavor to make your product stand out from the crowd. Building a product that mimics another in every tangible way seldom creates a ripple. This type of product tends to be uncompetitive against others in the market and eventually fail.

Products are often differentiated based on quality, features, and price. However, there are several other ways in which a product can stand out.

For example, your product differentiation might be based on finding a different audience to buy your product, making another channel irrelevant. A partner/ecosystem strategy that accelerates access to the product, such as placing your product in prime locations within a store, is another potential differentiation strategy.

Other approaches to product differentiation include creating awareness of the product with effective marketing.

Product differentiation doesn’t have to be additive; it can be subtractive too.

I recently explored watches for kids and found the lack of features to be attractive: no games, no social media, no distractions. I quickly eliminated a suite of products that provided such capabilities.

When done right, differentiation can help drive better profit margins, customer lifetime value (CLV), and return on assets.

Horizontal vs. vertical product differentiation

There are several ways to create product differentiation. That said, differentiation is driven by a market need (latent or active) in all cases.

When you consider the options available when you step out for dinner, your choice often depends on your individual (or group’s) preference and location. Such segregation falls under horizontal differentiation: same market, but different options that aren’t directly comparable and seek to assuage a personal need.

When you purchase a smartphone, the decision is based on price and features (camera, processor, memory, battery capacity, etc.). There is a direct correlation between price and features. The products are consciously designed for various market segments.

The placement often is also a function of the market segment. What you see in Walmart is generally different from what you’d find in Whole Foods, for example. Such separation is called vertical differentiation.

In many scenarios, you’ll see a mix of vertical and horizontal differentiation. Think of a Toyota Camry and the various trims as vertical differentiation, whereas the color spectrum qualifies as horizontal differentiation.

Here’s another example: breakfast bars have existed in the market for some time. However, when RXBar introduced its protein bars, it was directed at a specific market need with a desire for ingredient transparency and a higher price point. While it targeted active individuals, it offered another option, a breakfast bar, to other consumers.

What does a product differentiation strategy look like?

In the early stages of development, assessing the market need and the differentiation required can be tricky. Take autonomous cars, for example.

A mature product, such as smartphones, on the other hand, will leave few differentiation options.

There are several options by which a product can stand out in the market, including:

- Price

- Quality

- Features

- Branding

- Novelty

- Ecosystem strategy

- Market segment focus (broad, niche)

Identifying the best levers requires considerable analysis and can be highly speculative in the absence of data. This makes companies risk-averse and forces them to take a red-ocean strategy even when there is a clear path to a blue-ocean approach.

The questions I often hear from other product managers are:

- How do I develop a strategy to continuously differentiate my product to be desirable, viable, usable, and feasible?

- How do I identify triggers that signal the need for a new differentiation strategy?

- How do I determine the timing to shift my resources to the next best thing as opposed to minor product increments?

As a product manager, it’s your job to assess the ability of a new product against the market to determine whether it can offer sufficient differentiation that is profitable for the organization. Youcan accomplish this by identifying current market offerings, trends, product maturity in the market segment, and the gaps thereof.

With these insights, you can lead your teams to build an exciting new offer, time its entry into the market just right, and differentiate it sufficiently across multiple parameters. Once deployed, measure and monitor the product to review your strategies and augment them, including considerations to end-of-life offering.

Recognize current and potential trends

When assessing the potential for a new product or solution, it’s helpful to take stock of vital aspects of the current environment. I typically find the 5 Cs of situational analysis to aid in this discovery.

The 5 Cs are:

- Context

- Consumer

- Company

- Competition

- Collaborators

The context and consumer angle should inform of the market maturity, technological capabilities, captured pain points, and problems that remain to be solved. I often use Porter’s Five Forces model to identify (at an industry level) the supply and demand for such solutions, the product’s ability to be substituted, or the threshold for new entrants.

For example, Red Bull could be perceived as a substitute for coffee. Platforms such as Salesforce and Android continue to reduce entry barriers for startups. And so on…

We’ll get to collaborators in the next section, but no discovery is complete without competitive analysis. This is often the principal mistake startups make: assuming their work is pure greenfield. It’s crucial to consider the market needs against the offerings to define your MVP and determine how to stand out from the crowd.

Another essential part of this discovery process is to consider existing pain points that remain uncovered. These can often be minor with high upside potential and require domain expertise and a close watch of the business process (in B2B environments).

The best way to play this out is with your UX team to engage and shadow current processes using tools such as the five whys.

Eventually, this information gathering should answer the following:

- How saturated is the market?

- Are there specific market segments that are more attractive than others?

- How much coverage do current products deliver to current needs?

- How mature is the market? Is there any opportunity for differentiation?

- Who are the key players? How is the ecosystem set up today, and is there a potential opportunity to disrupt the ecosystem?

As an example, consider salvage vehicles. When salvors buy a vehicle, they often request a car history through Carfax. Unlike when purchasing a regular vehicle, the report isn’t as helpful. However, most salvors buy them for their records, and there aren’t additional details others can offer. What we have is a saturated market with a monopoly.

Imagine that data exists exclusively with your organization to build a better report. It certainly is an unmet (and latent) need. If we decided to pursue the same audience through the same channel (e.g., build a CarFax-like website), it would take years to displace Carfax because its audience is enormous.

The brand awareness and adoption of Carfax will position everything against you even though you have a superior product (at least on paper) and a lower price. We’ll follow this narrative to see if it’s worth pursuing in the next section.

Pinpoint what you can offer and identify opportunities to differentiate

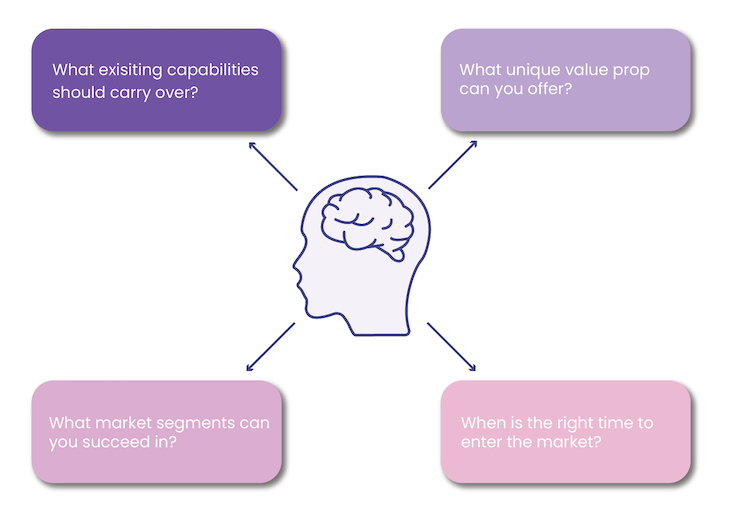

Getting to the specifics of what you can offer and where should be grounded on the following questions:

- What current capabilities can you carry over to the new product?

- Can you offer a value prop that is different from the existing solution? What is it?

- What market segments, if any, can you be successful in?

- Is it the right time to enter the market?

Following along with the Carfax example from the previous section, an alternative approach would be to go where the market access is.

The salvage vehicles are sold by insurance companies. Without getting into details, the theory of The Market for Lemons explains why a certified used vehicle gets higher bidding than a private party vehicle. The same economics of adverse selection can also explain why it is a win-win for insurance carriers.

Let’s say displaying such a report increases the value of a vehicle by $200, on average. We could sell such a report for $15–20 when a Carfax report sells for $5. When insurance carriers display this information, it eradicates the need for a CarFax report.

Since the top 10 insurance carriers account for about 75 percent of the market, scale is not an issue. A simple shift in the audience can get you significant market penetration at a much higher price point.

When differentiating a product, think beyond the direct competition. You’d be right to believe that this would obliterate the competitor, but not head-to-head.

Determine internal stakeholders and superpowers

It takes a village to build and deliver a product. Getting buy-in from stakeholders is critical.

When you consider building a differentiated product, that implies, as we mentioned before, viability, feasibility, and usability. Product differentiation often starts with the UX and the engineering teams assessing the cost of building the differentiation.

This, in turn, determines the product’s viability or pricing. It is possible, with good marketing, to improve the price point; when there is awareness, it drives a premium. Similarly, packaging good service — e.g., a warranty package or a customer success team — is another good strategy to ensure adoption.

This also implies your organization needs this capability. Don’t promise a differentiation you cannot deliver.

A concept that often falls to the wayside is communicability. Can you express the advantages of your differentiation in simple weekend language? If your sales and marketing teams don’t present an impactful statement on the value prop, it won’t matter how good your product is.

Measure and monitor

The process by which film producers in India monitor audience engagement and experiment accordingly to convert on-stage dramas into successful movies can inform our discussion about product differentiation. Over the course of 5–10 iterations, scripts originally written for the stage are tightened and refined for the big screen.

Imagine you had a way to do the same with your product. The key questions would be:

- How is the market reacting to the offering? What specific product features have been well-received? What isn’t working?

- How is the competition reacting to your product?

- What should the next product increment be based on the feedback?

- Is it time to let the product rest in peace?

I’m sure you’ve seen your share of products that Google introduces and shuts down. It would be simplistic to believe that these decisions are made frivolously, but every move Google makes regarding its products is based on data.

It is important to remember that maintaining a product requires continuous capital investment. Of course, capital is not an infinite resource. When one product holds it up, it deprives another, potentially one that can drive better revenues and profitability.

For this reason, it is crucial to measure and monitor product data to determine how every differentiation contributes to both positive and negative traction.

What is RoA and why does it matter?

Return on assets (RoA) is a standard measure of how well an organization makes its capital work. For example, you might have heard of inventory turns, to which RoA correlates.

Let’s say you have $1,000 in cash. You can purchase a product for $100 and resell it at:

- $101 @300 units annually

- $105 @50 units annually

- $120 @10 units annually

The last option is most attractive when you look at the profit margin (20 percent).

However, suppose you consider that you can buy 10 units, sell them quickly (in weeks), reinvest, and reiterate. In that case, you’d have made $300 on an investment of $1,000. The RoA is 30 percent versus 20 percent for the last option.

You make your money work harder, which can be a crucial differentiator. Meanwhile, the end consumer doesn’t care.

For example, Dell delivered on this logic and had considerably higher RoA than Compaq and HP in their respective heydays. Walmart continues to be a master of RoA.

Summary

The steps you should take when endeavoring to differentiate your product are as follows:

- Recognize current and potential market trends — Know who’s playing in this market and how

- Pinpoint what you can offer that stands out from the crowd — What core competencies can you carry over to play in this market?

- Determine your internal stakeholders — Identify their incentives and get them excited

- Measure and monitor — Know how to pivot with data, not opinions

The post What is product differentiation? Definition, strategies, and examples appeared first on LogRocket Blog.

from LogRocket Blog https://ift.tt/q8TYxV5

Gain $200 in a week

via Read more