Orion Protocol is a platform that allows crypto investors to swap various tokens and manage their cryptocurrency portfolios, all in one place. According to their website, “Orion seeks to solve the fragmentation of crypto markets, NFTs marketplaces, and assets from traditional finance by eventually aggregating them into one place: Orion Terminal.”

For Web3 developers, understanding how Orion Protocol and its 2021 release of the Orion Pool works is essential for remaining ahead of the curve in crypto and NFT trading.

In this tutorial, we will learn about Orion Protocol and Orion Pool. In addition, we will learn more about Orion’s Delegated Proof of Broker (DPoB) staking model and explore Orion’s use cases.

What is Orion Protocol and Orion Pool?

The Orion Protocol (or just “Orion”) is a defi platform founded in 2018 by Alexey Koloskov with the aim of providing profitable transactions by aggregating various crypto exchanges into one terminal. This terminal has many cryptocurrencies you can choose from.

The Orion Terminal works with the Orion liquidity pool (the “Orion Pool”), which contains various cryptocurrency tokens. These tokens are locked in a smart contract and used for crypto exchange, and to provide market liquidity. The Orion Pool is effective when compared to centralized liquidity pools because there are fewer intermediaries involved when executing crypto exchanges.

The Orion Terminal helps you see all decentralized exchanges in one place. Analyzing all your crypto investments in one platform boosts your ability to make data-driven decisions in the crypto market. Not only that, but it also gives you the best price and reduces slippage.

Slippage occurs when you have to buy a currency at a different or unexpected price because the cryptocurrency value has gone up or down. It’s caused by market volatility and can affect your investment strategies in a good or bad way, although it is best avoided because of its unpredictability.

With slippage, you can end up buying crypto tokens at a lower or higher price unexpectedly. If you place an order when Ethereum costs $2,532 and the order gets executed when Ethereum skyrockets to $3,000 at night, you have lost more money than you were expecting.

To solve the slippage problems, Orion aggregates immense liquidity in order to find the best price when executing transactions.

The ORN token is used to reward and facilitate Orion’s decentralized brokerage network. Here is a list of brokers available on Orion Network:

The Orion protocol is secured and audited by certiK in order to eliminate and prevent any security vulnerabilities that may arise. It also uses Elrond smart contracts, which are executed at a fast pace.

Analyzing Orion Protocol’s Delegated Proof of Broker model

The Delegated Proof of Broker (DPoB) model governs currency exchanges that occur on the Orion platform. It also allows brokers and non-brokers to stake their ORN and validate exchanges. This model helps the Orion network remain democratized and non-monopolized. Using the DPoB you don’t have to mine tokens; how much ORN you have determines your ranking in the brokerage network.

DPoB comprises of two stakeholders: brokers and non-brokers.

Brokers are responsible for carrying out trade executions from Orion’s liquidity aggregator. How many Orion tokens a broker has determines how many times she will be chosen to execute a trade. However, before brokers can execute a trade, they have to stake their ORN. Brokers receive incentives to charge non-brokers at a lower price.

Non-brokers who are Orion community members have to stake their ORN in order to vote for their desired broker. Brokers get a higher reputation and ranking whenever non-brokers vote for them to carry out transactions.

Use cases for Orion Protocol

Trade exchange and liquidity aggregation

The best part about Orion is that it has a cryptocurrency portfolio management module. This management module enables you to track your cryptocurrency exchange activity and monitor your metrics. It gives you information on your trading history, current balance, and profit or loss.

If you are investing in Ethereum tokens, you can set notifications that alert you when there are trading signals in the Ethereum market. It also offers asset management automation.

Swapping crypto tokens

Orion has a simple and beautiful UI used for swapping various tokens. All you need to do is connect your wallet and enter the amount of crypto you want to swap.

Provision of decentralized broker services

Orion makes it possible for investors to trade various cryptocurrencies in a single platform, because it has a network of brokers. The Orion trade terminal gives you the market performance metrics and provides an easy way for investors to deposit and deposit funds.

How to use the Orion Terminal

In this section, you will learn how to trade BNB to USDT as a way of learning how to use the Orion trading terminal. Before you start trading, make sure you have a MetaMask crypto wallet with at least 0.033BNB, or any other cryptocurrency value equivalent to 4.2ORN to trade on the Orion trade terminal.

Start by clicking on this link to access the Orion trading terminal. Next, click on the Connect Wallet button on the top right corner.

Next, select your favorite blockchain network and crypto wallet. This tutorial will be using the Binance smart chain network and MetaMask as the wallet. If you have not added Binance to your crypto wallet, click on the add network button below the Binace Smart Chain segment.

After you click on the MetaMask button, the MetaMask add-on in your browser will request your permission to grant Orion access to your MetaMask wallet. Go ahead and grant all permissions.

Next, click on the Connect button to complete the wallet connection procedure.

After you have connected MetaMask to Orion successfully, your wallet address will show on the top right corner.

Trading on the Orion Terminal

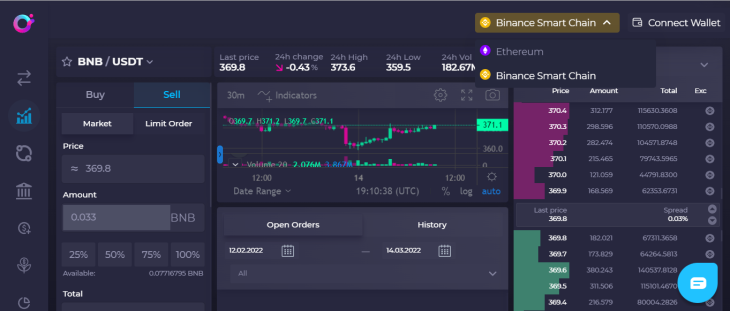

Click here to access the trading segment on the trading terminal. Next, click on the trading pair dropdown to get a list of trading pairs.

Use the search feature to find BNB/USDT pair. After you have selected a trading pair, enter the amount of BNB you want to sell.

The trading terminal will show you much USDT you will get in return when selling BNB, and will show you all transaction fees. If you agree with the transaction fees, go ahead and deposit BNB by pressing the Deposit BNB button.

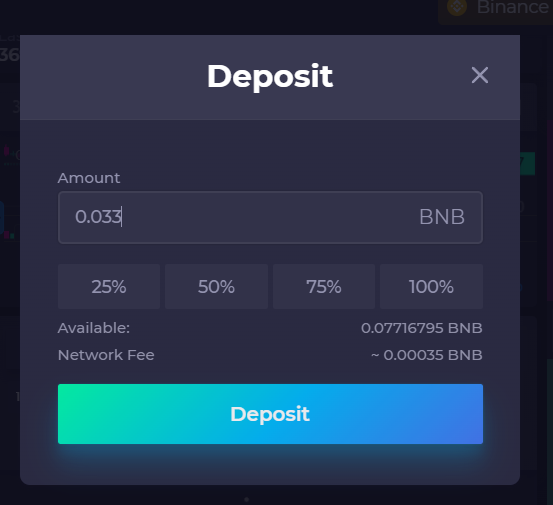

Next, you will be asked to enter the amount of BNB you want to sell again.

After you click on the Deposit button, MetaMask will ask for your permission to allow Orion to withdraw BNB from your wallet. Go ahead and confirm the transaction.

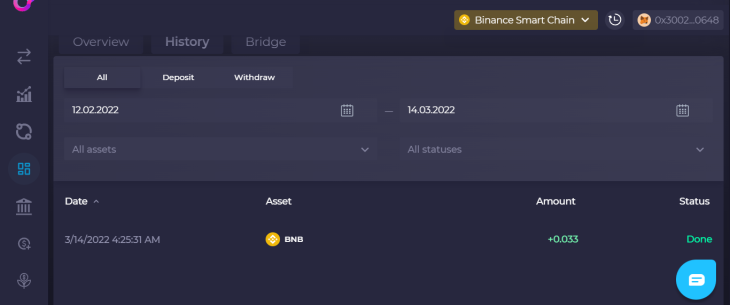

After you have deposited BNB, the transaction will be displayed on the history list on the dashboard, like so.

Since you have now deposited BNB, go back to the trading terminal and click the Sell button.

Next, MetaMask will ask for your signature permission to execute the transaction. Finally, click on the Sign button to complete the cryptocurrency exchange procedure.

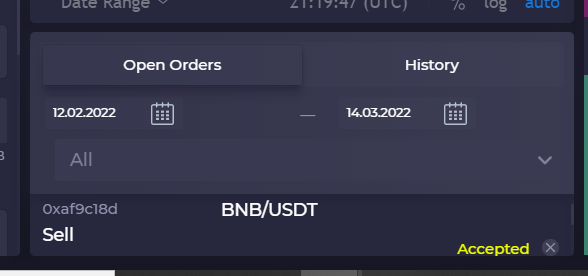

Open orders

After you have signed the transaction, the currency exchange details will be displayed on the Open Orders section. This section displays the transaction status (whether the exchange has been accepted or rejected). It will also display how much USDT you will receive in exchange for BNB.

Wait for the currency exchange to take place. After the exchange has been successful, click on the Dashboard to view your balances.

Withdrawing

Still in the dashboard, navigate below the Orion Bridge segment in the Overview page. Unfortunately, this segment cannot be expanded or adjusted to get a clear full view. So, scroll through the segment until you see the Withdraw button underneath the cryptocurrency you want to withdraw.

Next, enter the amount you want to withdraw and then click on the Withdraw button. Make sure you confirm the transaction when MetaMask asks for your permission. The USDT you are withdrawing will be deposited to your MetaMask wallet, which you connected to the Orion trading terminal.

You can check if the withdrawal was successful in the History tab.

Check your MetaMask wallet balance to make sure the correct amount was withdrawn from the Orion pool and deposited into the MetaMask wallet successfully.

Conclusion

In this tutorial, we have learned how to sell cryptocurrency using the Orion trading terminal. The Orion Terminal is better than other exchange platforms because it allows you to connect various wallets in order carry out trade transactions. If you are looking for an option for swapping tokens and trading cryptocurrencies, the Orion Terminal is a great choice.

The post A guide to Orion Protocol and the Orion Pool appeared first on LogRocket Blog.

from LogRocket Blog https://ift.tt/w2f8cRZ

via Read more